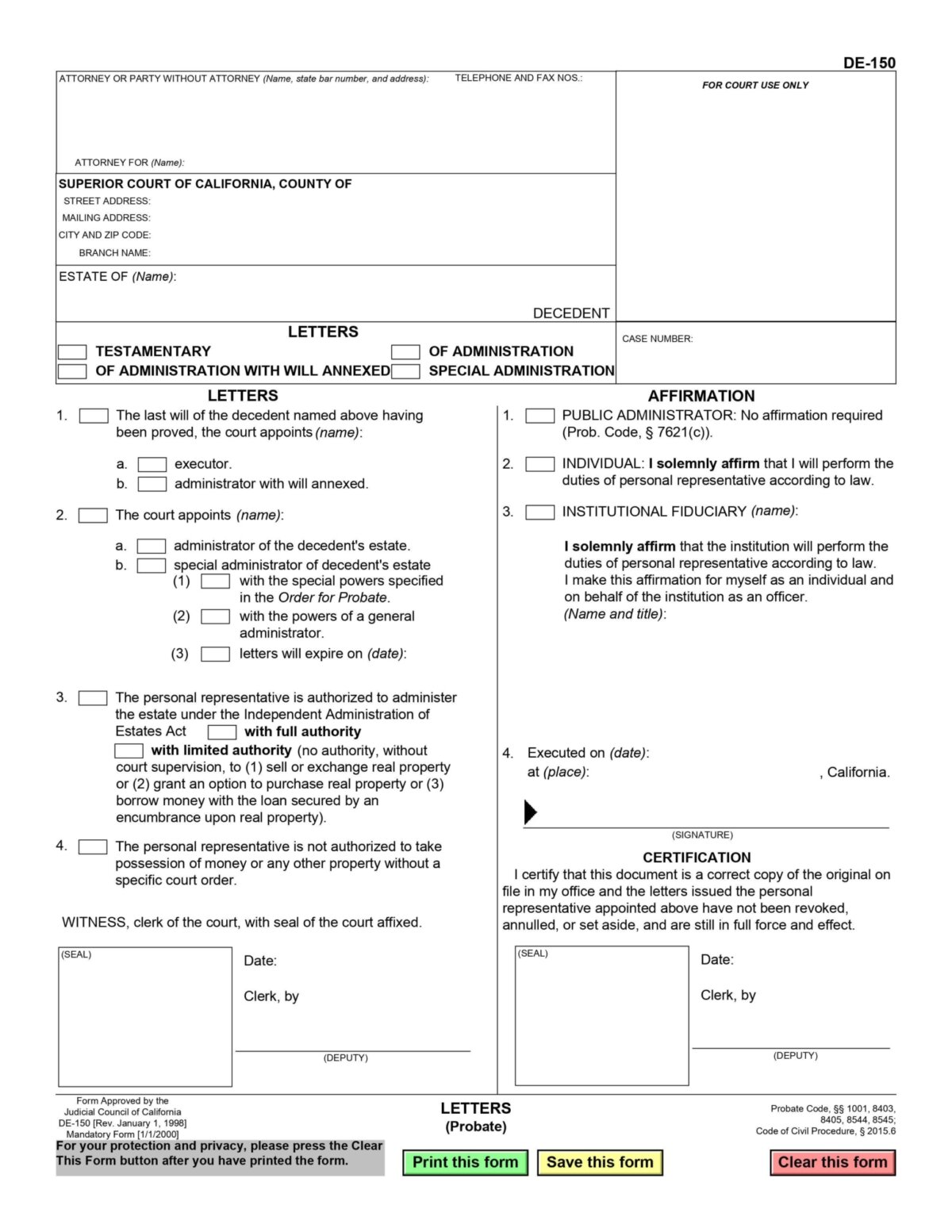

Prior to submitting the DE-150, be sure to secure a copy of the decedent’s death certificate that will subsequently be submitted to the court.

This can usually be obtained from the funeral home; and now would be a good time to request a few extra copies, as you may need them further down the road in this process. The original certificate will need to be submitted to the probate court, along with your DE-150 application.

Your next step is to develop a list of relatives who should be made aware of your official capacity as personal representative for the estate.

You may already know these family members, but they and any other potential heirs need to be contacted directly by you.

Obtaining as much financial information as possible about the decedent comes next, as it is imperative that you know what assets and debts have been left to deal with.

Some financial institutions may be unwilling to provide you with information until the Letters of Administration have been approved, but you should still be able to gather information about bank accounts, mortgages, property, credit cards, loans, stock or mutual fund investments, and any life insurance policies.

The probate court will accept estimates if you are unable to advise exact dollar amounts at this time. Be prepared, as well, to provide any tax forms that are required to be attached to the request for Letters of Administration.

You are now ready to file the DE-150 application with the county court where the deceased resided at the time of death.