Usually it takes an executor almost a year to settle an estate, with many just figuring it out as they go. We believe that it doesn’t have to be that way. With ClearEstate’s help, you can save:

- Over 120 hours of paperwork

- More than $8,500 in fees

- Countless headaches and stress-induced nightmares

Estate Settlement can be complex. Let us take most of the burden off your shoulders and do the heavy lifting for you.

Book a free consultation

Here's how we help you

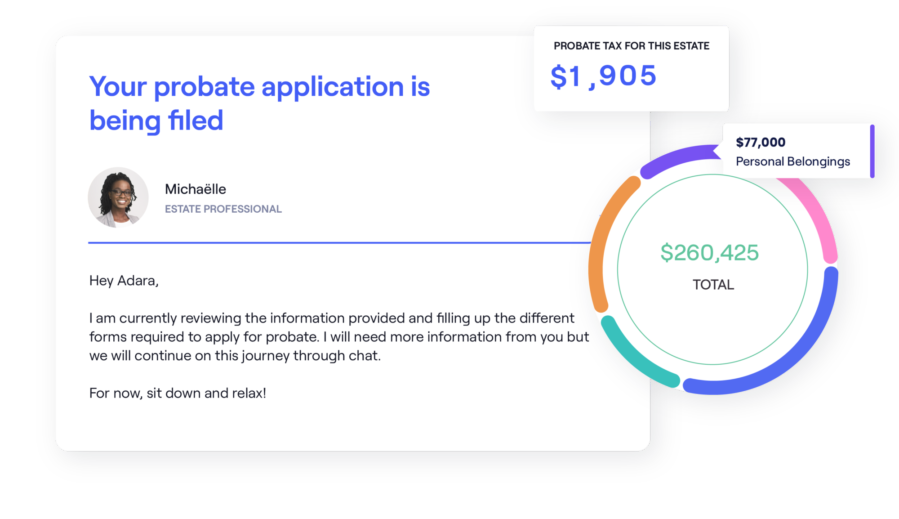

Probate

- Our handy probate checklist ensures you’re always on top of things

- We’ll help you prepare an inventory of the estate and get through the application paperwork.

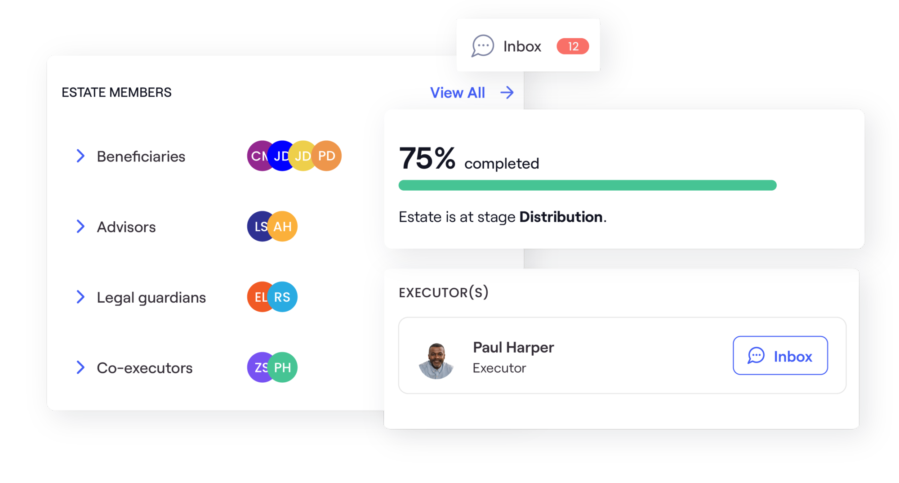

- Our intuitive dashboard helps you keep track of your progress

- No will? No problem. We’ll help you navigate the rules of probate for estates without wills

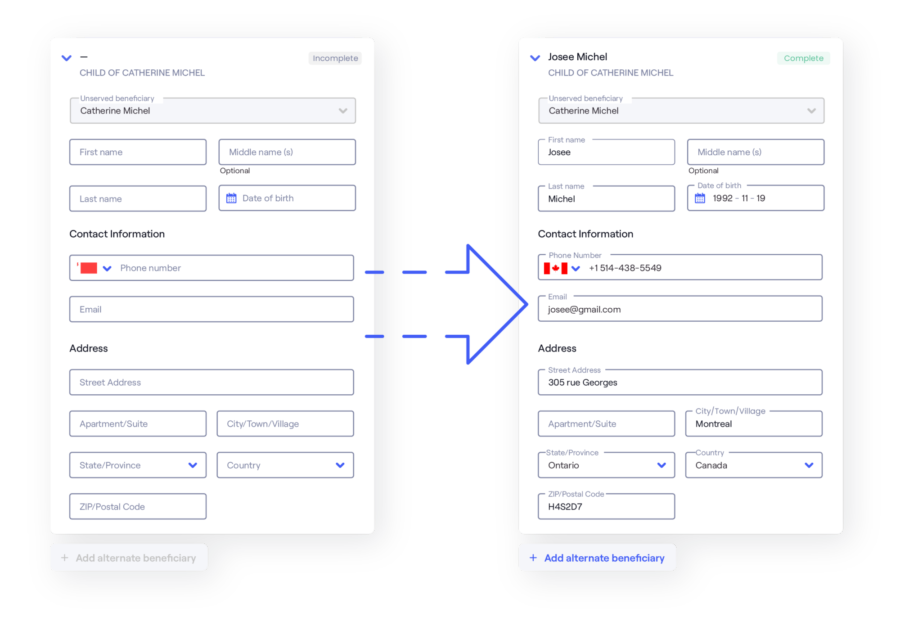

Paperwork wizardry

We simplified all the form-filing and record-keeping by creating an autofill feature for most documents, one-click form submissions

Our nifty activity log makes record-keeping a breeze

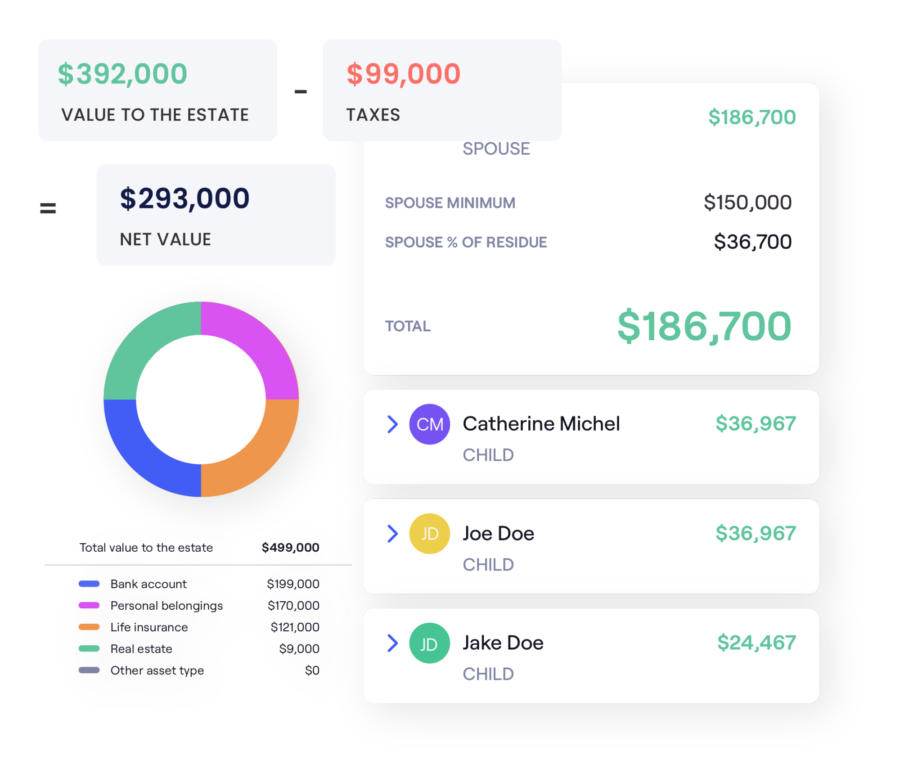

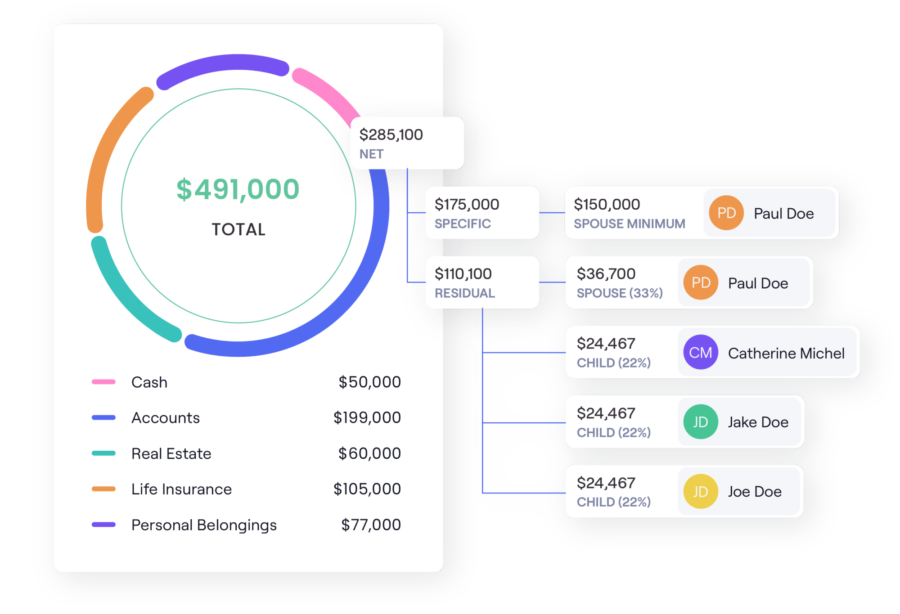

Cost estimates and inheritance calculator

You don’t need an accountant for simpler calculations. ClearEstate helps you keep track of fees and expenses

Our inheritance calculator lets everyone see exactly who gets what after all loose ends are tied up

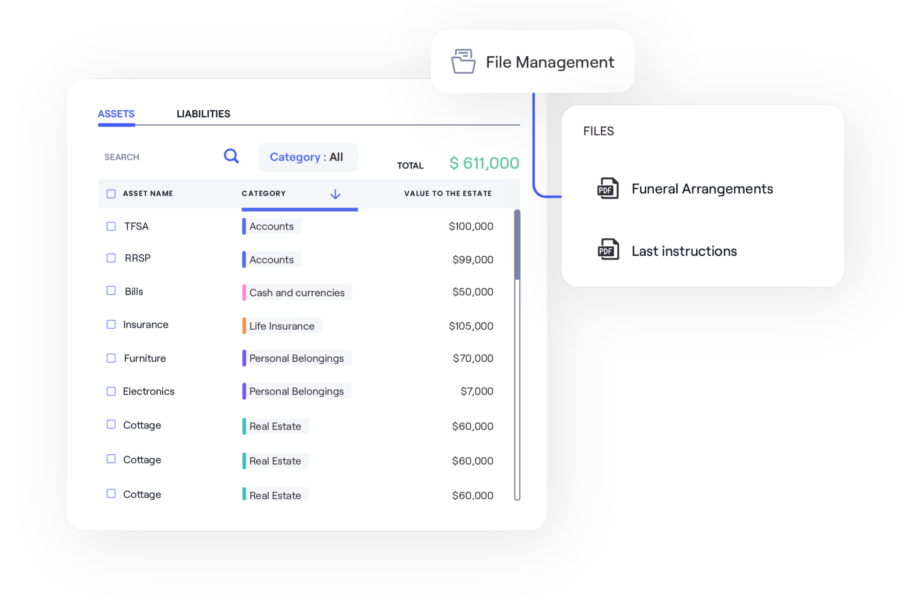

Accessible inventory

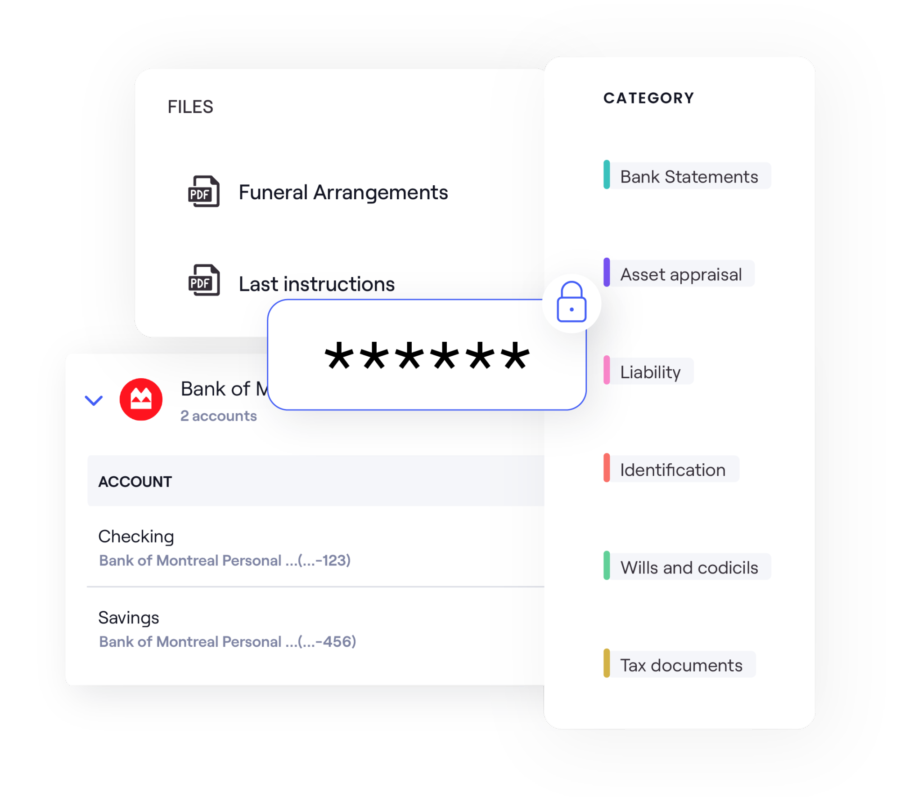

No more scrambling for receipts, notes, and other financial documents. Keep track of the entire estate, including debts, real estate, cash, pension plans, and personal property

Executors and beneficiaries have access to this inventory

Beneficiary Portal

Our beneficiary portal allows all authorized parties to follow the estate settlement progress in real time and rest easy knowing that there are written records of all communications.

The transparent nature of the portal helps avoid misunderstandings, frustrations, and hurt feelings.

Digital documents vault

Our digital vault ensures that every communication, transaction, and documents pertaining to the estate are kept in a safe place where only relevant parties can access them.

Estate distribution

ClearEstate's platform creates a clear distribution plan for the estate’s assets according to the will and your area of jurisdiction

Once that’s done, we’ll help you send off the right paperwork to properly close the estate.

Traditional Way

- Find and hire an attorney

- In person meetings

- Costly probate application

- 10 to 25 hours and extra costs of additional support

- Find and hire a tax accountant

- Extra costs to file taxes

ClearEstate Way

- Professional guidance & support

- Communicate via email, zoom, chat, phone, from your home

- Complete end-to-end support

- Online dashboard for all stakeholders

Essential

For executors or estate representatives seeking support settling their estate.

Total:Plus

For executors or estate representatives seeking support settling their estate.

Total:Professional*

ClearEstate and trust partner do all the work to settle the estate, for your total peace of mind.

Compare all features

1 Based on a purchase price of $650 you could pay a downpayment of $53.81 today, followed by 12 monthly payments of $53.81 at 15% APR for a total repayment amount of $645.73 ($596.19 in principal and $49.54 in interest). Well-qualified applicants may be eligible for 0% APR. Minimum $300 purchase required. Actual terms are based on your credit score and other factors and may vary. Not everyone is eligible. Applicants are subject to approval by Uplift Canada.

Any fees payable for services rendered to other professionals, such as appraisers, property managers, etc., and all estate expenses such as court filing fees, probate fees, etc. are not included. Some estates are more complicated to settle, such as where there are business interests, trusts, multi-jurisdictions, or where legislation requires the services of an attorney. In such cases, it may be necessary to engage other professional services at an additional cost to the estate.

*Professional plan is subject to review and approval of ClearEstate's fiduciary partner. Estates must be solvent and free from claims in order to qualify.

For more information, see our privacy policy and terms of use.