Estate Settlement

May 01, 2025

What to Do When Someone Dies in California

Follow this step-by-step guide to navigate legal duties, probate, and estate tasks with clarity and confidence.

Probate in Texas made simple. Explore our detailed FAQ for expert guidance on probate processes, and best practices in the lone star state.

Article Contents

You asked.

We have the answers.

Over time, we've seen a flurry of questions about probate in Texas pop up in our support chat.

Stemming from the most frequently asked questions we encounter, we've crafted this comprehensive FAQ to address these queries head-on.

Whether you're grappling with the complexities of estate management for the first time, are a concerned beneficiary, or are just seeking to be more informed, this guide is designed to provide clarity.

We heard from all of you and decided to create a central document about probate in Texas. Dive in, and let's go through the most frequently asked questions about probate we receive in Texas.

We understand that the world of probate comes with its unique set of terms and jargon. To make our guide more user-friendly, we've included a glossary for terms that might be unfamiliar. Here's a quick reference to help you navigate the complexities of probate with ease.

Probate: A legal process where a will is reviewed to determine if it's valid and authentic.

Decedent: The person who has passed away.

Executor: An individual named in a will to manage the deceased's estate.

Estate: All assets and debts left by an individual at death.

Beneficiary: A person named in a will to receive a part of the estate.

Intestate: Refers to dying without leaving a valid will.

Probate in Texas is a court process that recognizes a person's death and allows for the legal handling of their assets. Essentially, probate transitions the deceased's assets to the living.

This involves presenting the decedent's Last Will and Testament to the Court, which then decides to either supervise the estate administration directly or allow it to progress independently. The Court's role is to verify the Will's authenticity, after which they appoint an executor or administrator to identify assets and liabilities.

The executor, often named in the original will, works collaboratively with legal counsel to settle outstanding debts using the estate and subsequently distributes the remaining assets to beneficiaries listed in the Will.

While the majority of estates in Texas go through probate, some might be exempt depending on asset ownership. Texas also provides alternatives like simplified probate for specific estates.

The process typically starts with the original will's submission for validation. If deemed authentic, the court designates an "independent executor" to manage the estate. This executor then notifies the decedent’s creditors of the passing and settles valid claims.

To better comprehend probate: think of it as the methodical winding down of a person’s financial affairs, which includes asset inventory, debt settlements, and property distribution in line with their last will and testament. The process might vary among states, but Texas offers versatile probate solutions tailored to different estate complexities

Texas delineates three predominant types of probate processes: Independent Administration, Court-Supervised Dependent Administration, and Muniment of Title.

Independent Administration:

Court-Supervised Dependent Administration:

Muniment of Title:

Additionally, for smaller estates, Texas offers further streamlined probate alternatives, like the small estate affidavit. It's essential to select a probate type aligning with the estate's specific circumstances, considering its size, nature of assets, and potential disputes among heirs or beneficiaries.

In Texas, an estate exceeding a value of $75,000 necessitates a full probate administration. Notably, this $75,000 benchmark, as delineated in the Texas Estates Code, encompasses the cumulative value of the estate's assets, but it excludes the homestead and any exempt property.

Furthermore, Texas, like many other states, provides an alternative for estates below this value threshold. Specifically, if your deceased loved one's estate is valued at less than $75,000 and they did not leave behind a will, you can opt for a streamlined probate process. This is particularly significant as a substantial portion of Americans pass away without drafting a will, making this "small estate" approach a feasible option for numerous families.

When these two criteria are met – the estate's value and the absence of a will – you're afforded the opportunity to bypass the traditional, lengthier probate process. Instead, the Small Estate Affidavit can be employed to expedite the transfer of assets to the rightful heirs.

However, it's pivotal to remember that most estates, especially those where assets were solely in the deceased's name, will generally undergo the probate process. This is integral to verify the will's authenticity and ascertain the rightful beneficiaries of the deceased's assets.

In Texas, there isn't a universal mandate for all wills to undergo the probate process. However, the need for probate primarily hinges on the structure and titling of the decedent's assets. According to the Texas Estates Code Sec. 256.001, a will only becomes effective to validate title or right of possession of any property designated by the will once it's admitted to probate.

Circumstances Requiring Probate:

Ownership Structure: If the decedent's property was not titled or structured to bypass probate, the beneficiaries cannot access their inheritance without probate. This encompasses property solely owned by the decedent without a designated beneficiary.

Affidavit of Heirship Limitations: At times, an heir might refuse to sign an Affidavit of Heirship, or the estate's nature might deem the Affidavit inappropriate. When the estate holds significant value, third parties might hesitate to rely solely on the Affidavit for asset transfer. Moreover, entities like title companies usually require all potential heirs to partake in the Affidavit. If real estate or mineral interests exist without a "Transfer on Death" or "Lady Bird" Deed, probate becomes a probable necessity.

Probate as a Solution: In scenarios where other means are untenable, probate might be the sole avenue. One such method is the 'Probate as a Muniment of Title,' which can be invoked when the estate's debts are solely liens on real property. This method offers a more cost-effective probate alternative.

In short, not all Texas wills need probate. But it's crucial when the deceased had more assets than debts. Probate ensures the lawful and orderly distribution of assets according to the decedent's last wishes.

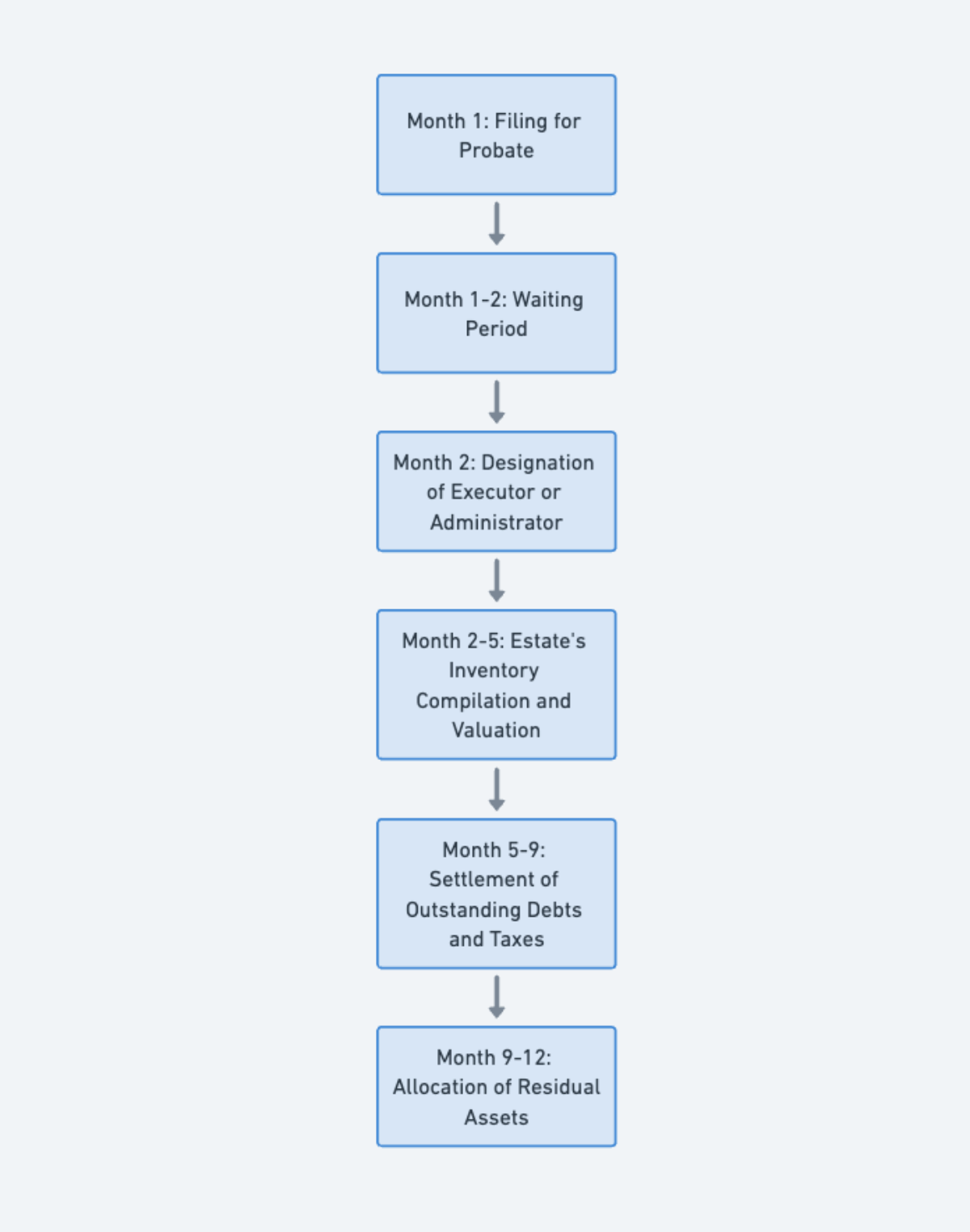

On average, probate cases in Texas span from three to six months. However, this duration is subject to variations. In straightforward situations, where the estate is uncomplicated, a will could be introduced to probate court in merely 30-45 days, allowing the entire process to potentially wrap up within half a year.

Yet, the probate timeline in Texas can fluctuate based on the estate's complexity. For estates that are more intricate or encounter issues—like a contested or missing original will—the probate duration can stretch to a year or even more.

Such complications can cause the court to delve deeper into the proceedings, extending the time frame.

It's crucial to remember that probate can be a multifaceted and bewildering procedure, whether you're the estate's executor or a beneficiary. Engaging a Texas probate professional can offer invaluable guidance, ensuring the process unfolds with efficiency and clarity.

In Texas, if you neglect to probate a will within the critical four-year window after an individual's passing, the will generally becomes void. As a result, the estate is distributed based on intestate (without a will) succession.

Furthermore, intestate succession can lead to unintended consequences. For instance, in cases where a will isn't probated, children from a previous marriage could inherit the deceased's half of any shared property.

This could drastically reduce what a surviving spouse receives, diverging significantly from the deceased's wishes. Thus, an estate that would've been fully inherited by the spouse now only provides her with half, with the other half distributed among other relatives. Such outcomes exemplify the importance of probating a will in Texas

While Texas law allows some wills to be probated without an attorney, it's often advisable to have one. In Texas, most courts mandate an executor to seek legal counsel in probate proceedings. This is rooted in the fact that an executor represents not just their interests, but also those of beneficiaries and creditors. Under Texas legislation, representing the interests of others is a privilege reserved for licensed attorneys, and managing probate matters without one could be seen as unauthorized practice of law.

Specific counties in Texas, such as Dallas, Denton, Galveston, Harris, Hood, and Travis, enforce the requirement for executors to have legal representation when acting on behalf of others.

On the flip side, there are exceptions. For instance, probating a will as a muniment of title—a simplified probate process in Texas—may not necessitate a lawyer if the executor is the sole beneficiary and there are no other debts against the estate save for those tied to real estate. Another exception is the use of an affidavit of heirship, where all heirs might collaboratively file the affidavit without legal assistance.

That being said, probate in Texas is a legally monitored procedure. Securing an attorney's guidance can streamline the process, clarify legal intricacies, avert potential setbacks, and provide peace of mind. Regardless of whether it's a full-scale probate or a muniment of title, an attorney's expertise can be invaluable in navigating the intricacies of the probate landscape.

Probate can be a challenging process, filled with legal intricacies and potential pitfalls. Through this guide, we've aimed to demystify the subject and provide clear answers to common questions. Remember, while the probate process may be daunting, you don't have to navigate it alone.

Probate is hard. We make it easy. Our probate professionals are adept at Texas probate law and are dedicated to guiding you every step of the way. If you have further questions or need personalized assistance, don't hesitate to book a free consultation today.

Simplify Probate Today

Simplify Probate Today

Get expert guidance from our specialists who've helped 10,000+ families.

Book a free consultation