Estate Settlement

Jul 25, 2024

How to Transfer a Deceased Person's Vehicle in Arizona

Learn the step-by-step process to transfer a deceased person's vehicle in Arizona, including required documents and steps to ensure a smooth transfer.

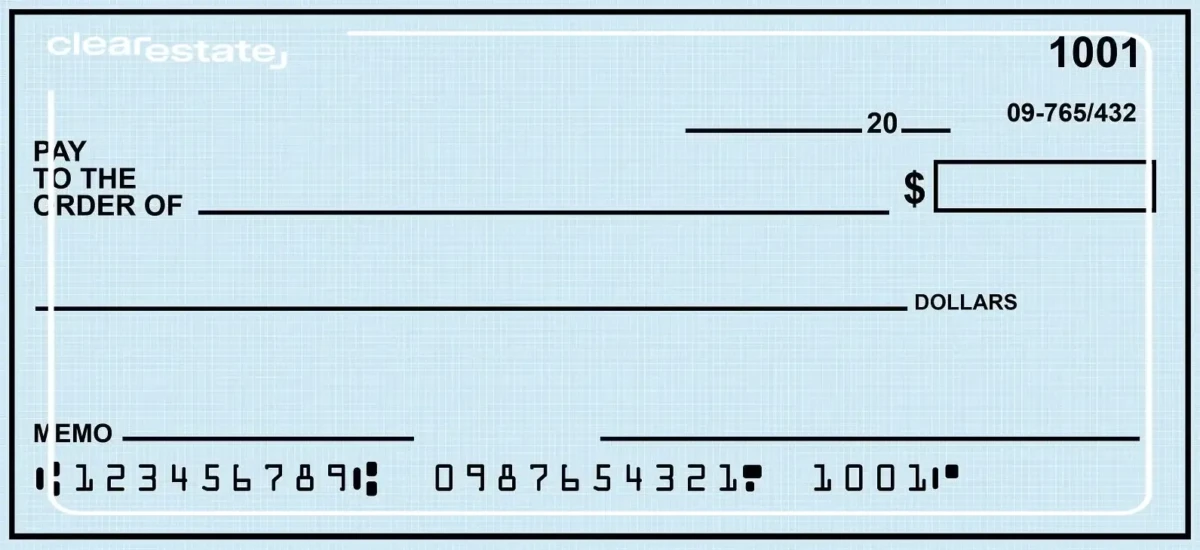

Handling the finances of an estate is one of an estate executor’s main responsibilities, and in most cases they’ll have an estate account through which all financial transactions related to the estate will flow. That way, the executor can write checks from the account and deposit checks into the account, later distributing the funds in accordance with the will. The executor can also deposit or legally endorse and cash a check made out to the deceased, although the bank will often require a grant of probate validating the executor’s role before allowing any financial transactions to take place. Some banks may also be hesitant about allowing executors to cash estate checks, since the flow of funds becomes less transparent.

We regularly share relevant information about wills and estates.

The executor cannot, however, deposit checks into their personal accounts.

If you’re a beneficiary, you can’t simply cash or deposit checks made out to the deceased or their estate. You’ll need to receive your inheritance through the estate account.

Still have questions? Reach out to our team of experts at ClearEstate, where we’re happy to discuss everything relating to estates, from drafting wills to creating good executor-beneficiary relationships. Get in touch for a free consultation.

Need help with probate?

Need help with probate?

Get free, personalized guidance from our estate specialists who have guided over 10,000 families through probate. Book a free, no hassle and confidential consultation today.

Speak to an estate specialist today