Estate Planning

Oct 27, 2025

Introducing Empathy to Estate Bureaucracy

ClearEstate’s origin story: how grief, inefficiency, and compassion inspired Alex to build a fintech that brings empathy and efficiency to estate planning and settlement

Make the process of opening an estate account simple and straightforward with this step-by-step guide. Learn how to gather documents and fulfill your executor duties.

When managing a loved one’s estate, it can be challenging to know where to start. If you’ve already begun the probate process, assuming a will is in place, the next important step is opening an estate account. But what exactly is an estate account, and how do you open one?

An estate account is a temporary bank account used to hold an estate’s assets and funds. It helps manage estate expenses, pay taxes, and distribute assets to beneficiaries efficiently.

Having an estate account allows you not to commingle your personal assets and those of the estate.

An estate account is typically opened by the personal representative or executor of the estate, once they have been appointed. But, there are some additional steps required to open an estate account, as the process is not automatic.

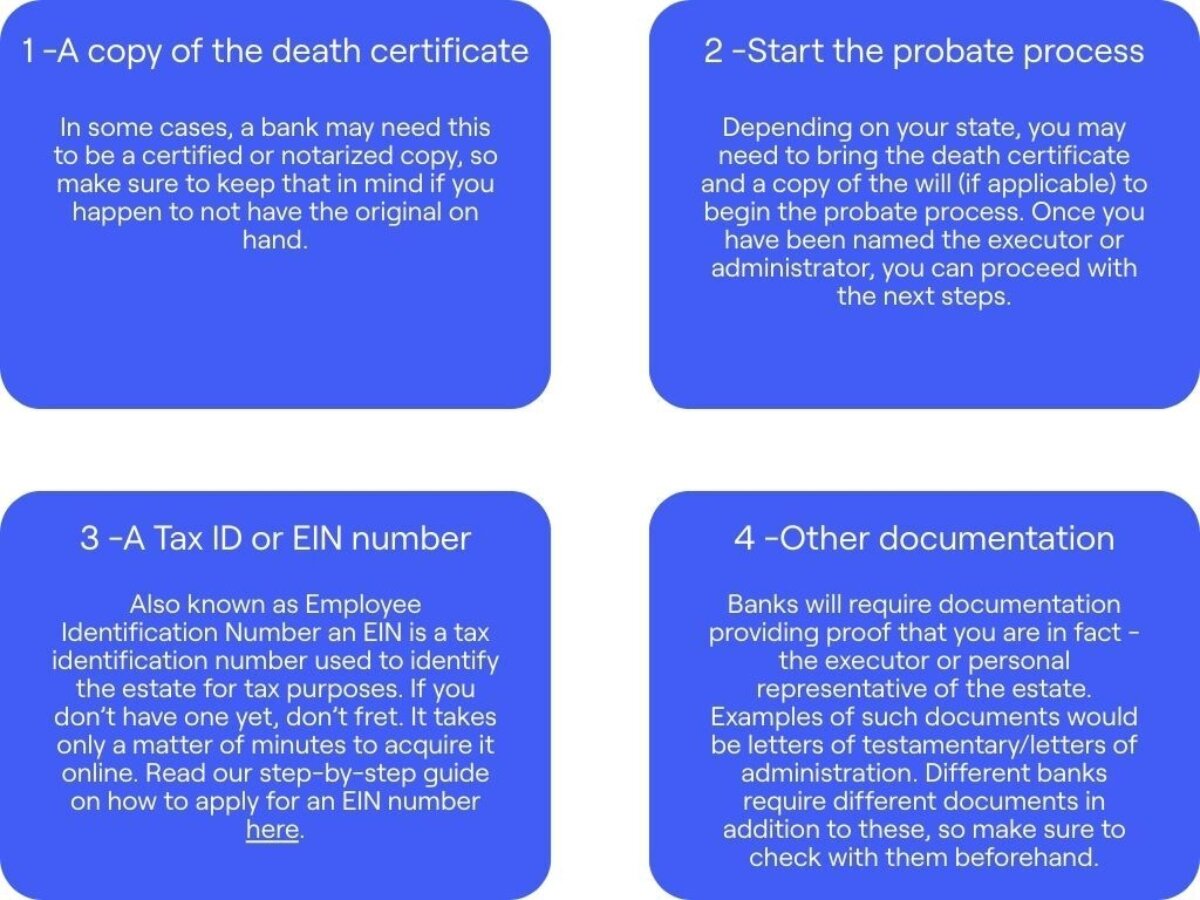

Opening an estate account is a crucial step for executors or personal representatives once they’ve been appointed. But the process isn’t automatic. To ensure smooth approval, you’ll need to gather the following key documents:

Remember: Though online banking is ubiquitous in the industry, banks may need you to come in person to set up an estate account. Never assume all your financial needs can be done from a laptop, as convenient as that may be.

1. Find a local bank - Choosing the same financial institution that the decedent used is the best option when it comes to choosing where to open the estate account. Keep in mind that opening an estate account outside of the decedent’s state of residence could incur additional charges.

2. Confirm the Bank’s Requirements - In addition to the basic documents, each bank may have specific requirements for opening an estate account. You should ask the following questions (and others) to ensure you’re prepared:

3. Open the account - Once you have your EIN and all the required documents in place, take the final step and open your estate account. While you do have the option to choose a checking or a savings account, opening a simple checking account is a more prudent choice. This avoids unnecessary fees when transferring assets, especially if the savings account lacks checking privileges.

4. Start transferring - Once the account is opened, you can begin transferring any estate assets owned by the deceased into the new estate account. However, certain assets are not part of the estate because they transfer directly to beneficiaries or co-owners. Here are some examples of assets that bypass the estate account:

Once you have transferred all the applicable assets, remember to close any of the decedent’s bank accounts once they are empty.

The best bank to open an estate account is usually the decedent’s existing financial institution. This simplifies the process since the bank already has relevant account information, making it easier to verify the decedent’s assets and reduce administrative delays.

Also, if the decedent had any investment accounts (IRAs, for example) many banks have brokerage services that allow you to easily access these accounts as well.

Many banks also offer specialized estate account services, including dedicated support for executors and personal representatives. While we don’t endorse specific banks, here are some institutions known for providing comprehensive estate account information:

In cases where the decedent held a joint account with a spouse or another individual, the account typically transfers to the remaining account holder. So, do you still need to open an estate account if you already have access to the joint account?

The answer is yes, opening a separate estate account is often the better choice. Here’s why:

Often individuals have multiple accounts for many different purposes, especially if they owned a business or were self-employed. An estate account consolidates all funds in one place, making it easier to track, manage, and distribute assets efficiently.

The executor has a fiduciary duty to keep personal finances separate from estate assets. When the executor is the remaining joint holder of an account that also has their own personal funds, the chance of them comingling the estate funds and their personal funds increases. Choosing to open an estate account separate from your personal accounts is arguably a safer solution.

An estate account makes it easier to track transactions, especially when managing multiple income sources like property sales, dividends, and investments. Clean, organized records simplify reporting during probate and reduce the risk of accounting errors.

Somewhat related to our first point, instead of juggling multiple accounts, an estate account acts as a central hub for all incoming funds. This simplifies the process of managing proceeds from investments, property sales, and other income streams.

If having fewer worries about the estate’s funds sounds appealing, we’re on the same page. Our estate accountants and probate professionals are experienced in all matters related to estate administration and the like. Let us help you get the estate affairs in order - contact us today, starting with a no obligation free consultation.

Simplify Probate Today

Simplify Probate Today

Get expert guidance from our specialists who've helped 10,000+ families.

Book a free consultation