Estate Settlement

May 01, 2025

What to Do When Someone Dies in California

Follow this step-by-step guide to navigate legal duties, probate, and estate tasks with clarity and confidence.

Being named executor in California often lands like a quiet obligation — a name on a piece of paper you didn’t expect to see so soon. Suddenly, the title carries weight.

Being named executor in California often lands like a quiet obligation — a name on a piece of paper you didn’t expect to see so soon. At first it can feel honorary. Then you hear the words probate, debts, taxes, and suddenly the title carries weight.

The most common early worry isn’t what you’re supposed to do.

It’s this:

“If I make a mistake, will I be personally on the hook?”

That fear isn’t imaginary — but it’s also not the whole truth. California law draws a clear line between estate responsibilities and personal liability, and most of the time, the latter never materializes for careful, informed executors.

Below is a clear, jurisdiction-specific guide to what does and doesn’t expose you personally when you’re just starting in this role.

In California, the executor — legally called a personal representative — is responsible for administering the estate through probate. That includes marshalling assets, paying debts from the estate, and distributing property according to the will or law. But estate obligations belong to the estate, not to your personal finances.

A personal representative has certain duties and liabilities under state law, and failing those duties can create personal exposure — but simply being the executor does not make you personally responsible for the deceased’s debts or taxes.

For a neutral overview of the legal role of a personal representative, see the general explanation here: Personal representative (executor/administrator) duties.

These are the things that cause the most unnecessary executor anxiety:

Credit card bills, medical charges, utility balances — these are paid from estate assets. If there isn’t enough money, creditors typically absorb the loss under California law.

Filing the final returns and paying estate taxes are the executor's duties, but the money is estate money, not your own.

Executor decisions often spark frustration — especially when time drags or expectations differ — but emotional reactions are not legal liabilities.

An estate that lacks funds to pay all claims is not executor misconduct. California provides a priority system for settling obligations.

In short, you’re not guaranteeing the estate like a personal loan. Your job is to follow the process, not pay from your own pocket.

Here’s a link to a practical self-help guide for California Courts.

Personal exposure in California doesn’t come from the gravity of the role. It comes from violations of legal responsibilities, or unintended departures from statutory rules.

Here are the main risk zones:

This is by far the most frequent and problematic situation.

California probate law gives creditors a defined window to present claims — and you have to respect that process before you distribute assets to beneficiaries. If you pay beneficiaries too early and a valid creditor emerges later with a claim, the court could hold you accountable for the shortfall because the priority order was skipped.

This is not because you owe the debt; it’s because you didn’t follow the legal order of responsibility.

For an official breakdown of what the personal representative does after appointment — including marshalling assets, paying debts, and distributing remaining property — see the California Courts probate self-help page: Administering the Probate Estate (Superior Court of California).

The California Courts’ own guidance on executor duties stresses separation of estate resources. If you deposit estate funds into your personal account, or use your own account to pay estate expenses and fail to document the transactions clearly, you blur the line between estate money and your personal finances.

This sort of commingling — even if unintentional — can lead courts to require reimbursement from your personal funds because the court’s job is transparency: it has to be clear what belongs to the estate and what belongs to you.

Executors are not expected to be lawyers — but once you agree to serve, you’re expected to follow California’s probate framework closely. The California Courts form DE-147 (Duties and Liabilities of Personal Representative) outlines exactly where obligations lie, including filing required inventories, notifying creditors and beneficiaries, and keeping accurate records.

Common process mistakes that can create exposure include:

Failing to notify creditors within the required timeframe

Not filing an inventory and appraisal when required

Distributing assets without court approval when approval is lawfully needed

Failing to maintain accurate, detailed records

It’s not a penalty for being executor — it’s accountability for failing to follow legally defined steps.

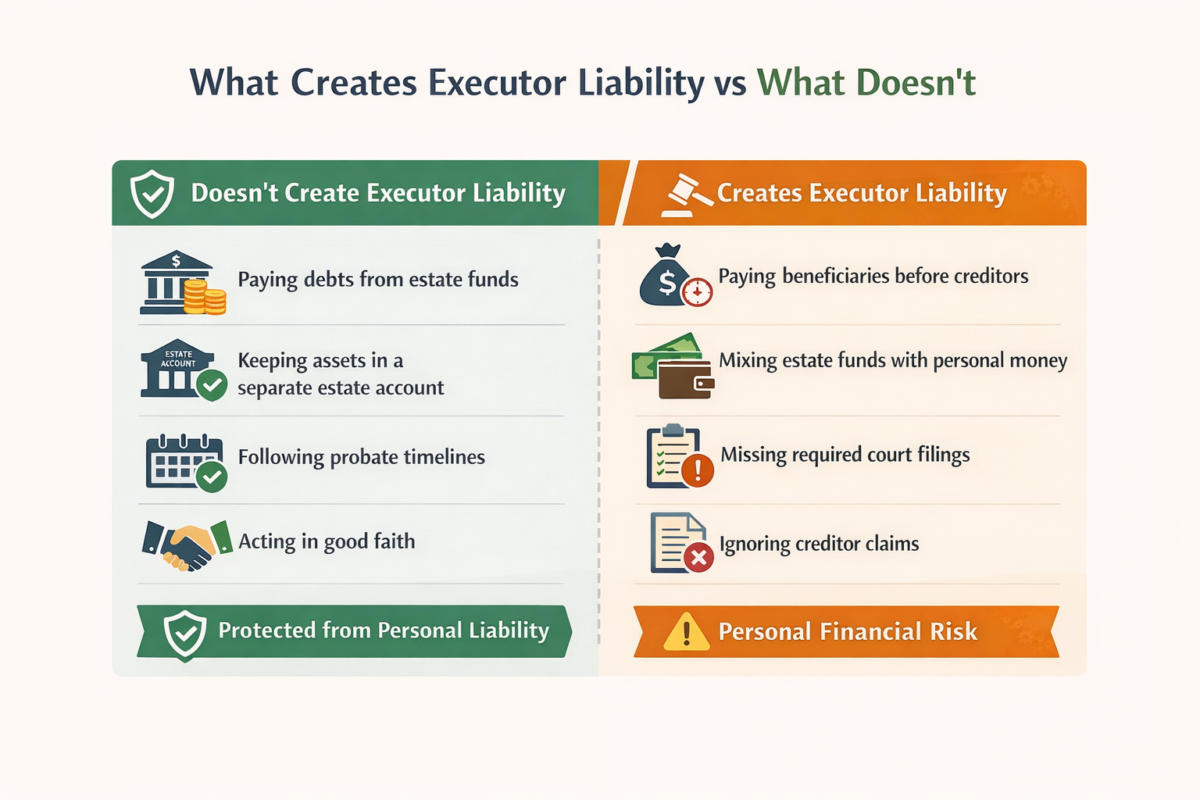

Most executor liability concerns in California come down to a small set of actions — and just as importantly, a much larger set of things that don’t create personal risk.

Here’s the simplest way to see the difference.

The rest of this article walks through these risk areas in more detail — so you know where to slow down, and where you don’t need to worry.

Yes — an executor can be named in a lawsuit as a defendant. That’s different from being personally liable.

There are two common reasons such lawsuits happen:

A beneficiary thinks the executor mismanaged assets or misinterpreted the will

A creditor believes a valid claim was ignored or improperly handled

Courts don’t treat executor lawsuits lightly, but they evaluate the facts: Did the executor act in good faith? Did they follow the law and document decisions? Was there self-dealing or an obvious breach of duties?

In most contested situations, courts protect executors who act reasonably and transparently.

Yes — and there’s an important distinction here.

Before you accept the role and perform significant actions, you can formally decline the appointment. Once you start acting — opening accounts, paying bills, signing documents — expectations become harder to unwind. If you’re overwhelmed or uncertain, it’s better to clarify your comfort and support needs early.

California’s self-help probate resources explain how a personal representative is appointed and what qualifies someone to serve:

Estate representative (California Courts Self-Help).

One of the most counterintuitive parts of serving as executor is this:

You don’t get into trouble for the emotions of the situation. You get into trouble for the processes you skip.

Rushing, assuming precedent, or trying to “keep the peace” by paying people early often does more harm than good in a probate setting. The law isn’t there to slow you down arbitrarily — it’s there to protect everyone’s rights, including creditors, heirs, and yes — the executor.

Being methodical, patient, and clear with records is your strongest defence against personal exposure.

California’s Probate Code defines the personal representative’s obligation as one of ordinary care and diligence when managing and controlling the estate. That’s the standard by which courts measure conduct.

In plain terms, this means:

You must manage estate resources carefully

You must act in the estate’s best interest, not your own

You must avoid conflicts of interest and clearly document decisions

This is not perfection. It is reasonable care under the circumstances.

Think of your role as administrator rather than guarantor.

You don’t pay the estate’s bills from your own account by default. You don’t personally owe debts because you’re named executor. You don’t shoulder taxes, utility bills, or longstanding balances unless you breach fiduciary duties.

Your risk isn’t the title — it’s the decisions you make, documents you file, and attention you give to the process.

Approach each task deliberately, keep clean separation between personal and estate matters, and seek clarity — not speed — in your actions.

That’s how executors protect themselves in California — and serve the estate responsibly at the same time.

Simplify Probate Today

Simplify Probate Today

Get expert guidance from our specialists who've helped 10,000+ families.

Book a free consultation