Estate Settlement

May 01, 2025

What to Do When Someone Dies in California

Follow this step-by-step guide to navigate legal duties, probate, and estate tasks with clarity and confidence.

Uncover the potential problems with Transfer on Death deeds and learn how to avoid them in our detailed guide.

Imagine being able to pass your estate to your loved ones without the delays and hassle of the probate process. Transfer on Death deeds are designed to do exactly that.

Transfer on Death deeds (ToD deeds) let property owners name a beneficiary who would receive the property upon their passing. It is a means to help streamline the transfer while avoiding probate.

On the surface, Transfer on Death deeds appear to be a good plan—but hidden dangers require cautious attention. Examining the possible problems with Transfer on Death deeds will help you manage the complexity of estate planning and make choices consistent with your objectives and priorities. Let’s explore these issues in more detail.

Understanding Transfer on Death Deeds: This legal document allows property owners to bypass probate by naming a beneficiary to receive the property upon death.

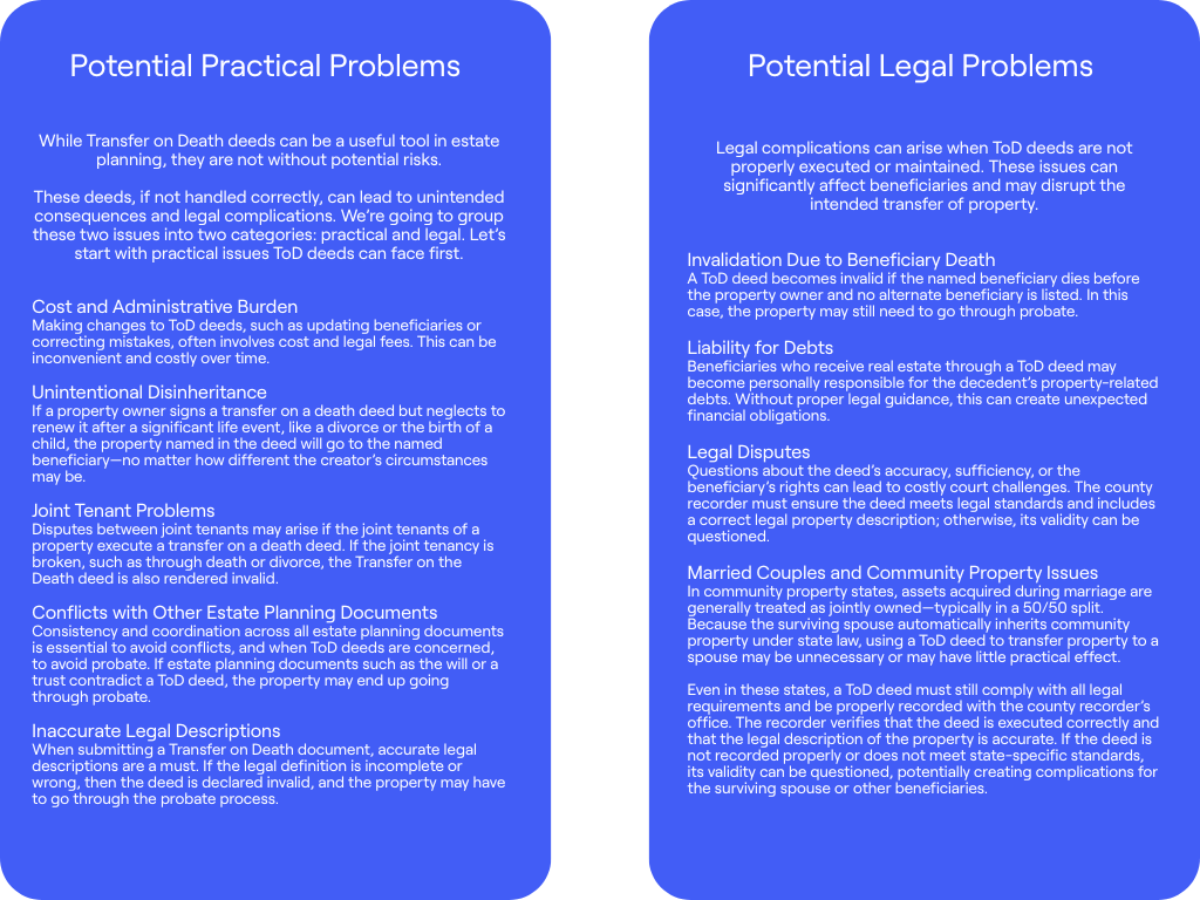

Practical Problems with Transfer on Death Deeds: Issues can include unintentional disinheritance, conflicts with joint tenants, and invalidation due to legal description errors.

Legal Issues to be Aware of: Legal problems can arise from these deeds, unless proper care is taken.

Alternatives to Transfer on Death Deeds: Alternatives like living trusts and joint ownership can be a different route to avoid probate aside from ToD deeds, offering different pros and cons.

A Transfer on Death deed is a formal document that enables a property owner to transfer ownership of their assets to a named beneficiary in the event of their passing. This allows property named in the deed to bypass probate entirely.

If a property owner has executed a transfer on the death deed, the property shifts to the person nominated only once the owner dies. The beneficiary is not required to appear in court. By law, they immediately own the property.

By way of analogy, using a ToD deed is similar to using a payable on death designation on a bank account.

Transfer on Death Deeds: Problems in Action

To illustrate the specific legal issues that can arise from improperly using Transfer on Death deeds,, let’s examine a relevant court case decided by the Kansas Court of Appeals.

Lori McGregor vs. Scott McGregor (Kansas Court of Appeals)

In this case, both Scott and Lori are siblings from mother Jo Ann Edwards. Edwards owned a property in Yates Centre. In 2011, Edwards executed a ToD deed to transfer her property to both Scott and Lori as grantee beneficiaries. Four years later, Edwards signed another ToD deed naming both children as grantee beneficiaries and joint tenants. The same year, Edwards also executed a durable power of attorney giving Scott the ability to deal with her finances. Finally, a third ToD deed was executed and filed in May 2016, though it differed greatly from the others—it only named Scott as the individual to receive the property upon Lori’s death. Critically, the final ToD deed did not contain the language “as grantee beneficiary” next to Scott’s name.

Two days after Edwards’ death in 2020, Lori brought forward a motion to stop the final ToD deed from coming into effect and petitioned the courts to invalidate the final ToD deed. She claimed it did not “comply with the [ToD deed] statute” under Kansas law as the instrument did not contain the key phrase “grantee beneficiary” beside Scott’s name.

A district court sided with Scott’s lawyer’s arguments in upholding the final ToD deed and the power of attorney granted to him. However, Lori brought the matter before the Court of Appeals. Ultimately, the higher court agreed with Scott’s counsel that the final ToD deed was valid as it was “substantially in the following form” as outlined in the appropriate Kansas statutes.

The lesson? Even a minor missing detail in a ToD deed, especially if family relations are tenuous, can result in years of legal issues—even if probate is avoided.

Transfer on Death deeds have long been a common way to leave properties to heirs. However, there are alternative methods worth considering for those who want more comprehensive and flexible estate planning options. This includes tools like joint ownership and living trusts, which offer different advantages depending on your goals and circumstances. Below is a detailed discussion of these alternatives and a summary of practical choices available.

A living trust, sometimes referred to as a revocable or living trust, is a legal structure that enables you to put assets into a trust while you are living and name beneficiaries to inherit those assets after your passing. The trust is administered by a trustee, who may be you or a person of your choice. You may change or revoke the trust at any time during your lifetime.

Pros of a living trust | Cons of a living trust |

Avoids probate: Assets maintained in a living trust are often not subject to the probate procedure, which saves your beneficiaries time and money. | Upfront effort: Setting up a living trust requires more work upfront than completing a transfer on a death deed. It also costs more money. |

Privacy: The specifics of a living trust are kept private, unlike probate, which is a public procedure. | Ongoing management: A living trust must be managed continuously, which includes paying the trust and revising beneficiary designations. |

Flexible: Living trusts handle assets in the case of incapacity and allow for more sophisticated estate planning techniques. | Not necessary for simple estates: People with simple estates do not need the additional complexity of a living trust. |

A form of co-ownership in which two or more people have equal ownership stakes in a piece of property is called joint ownership, also known as joint tenancy with the right of survivorship.

Pros of joint ownership | Cons of joint ownership |

Instant ownership transfer: If one owner dies, the property automatically shifts to the surviving owner(s) without going through probate. | Lack of control: Joint ownership entails all owners having the same control and authority over the property, which may be better in some circumstances. |

Streamlined transfer: Joint ownership is established without additional legal paperwork or continuous administration. | Limited planning possibilities: Joint ownership offers fewer flexibility or planning options than other estate planning methods. |

Different states have different rules and regulations for Transfer on Death deeds. Given the differences in state laws and procedures, it is strongly recommended to speak with an estate planning expert who is knowledgeable about the regulations in your state. They can give you individualized guidance, guarantee adherence to state-specific laws, and assist you in successfully navigating the Transfer on Death deed process.

To help you understand some of the state-specific statutes regarding ToD deeds, here’s a quick review chart of common legislative differences between three different states: California, Texas and New York.

State | Key Statute | ToD Deed Provisions |

California |

| |

Texas |

| |

New York |

|

Did you know? New York only just codified Transfer on Death deeds in July of 2024. Prior to then, any transfers on death had to be done with alternative mechanisms such as wills or living trusts.

Simplify Probate Today

Simplify Probate Today

Get expert guidance from our specialists who've helped 10,000+ families.

Book a free consultation