What does dying intestate mean?

Dying intestate means passing away without a valid will. When this happens, the deceased person's assets are distributed according to intestate succession laws, which vary by state.

Who inherits when there is no will?

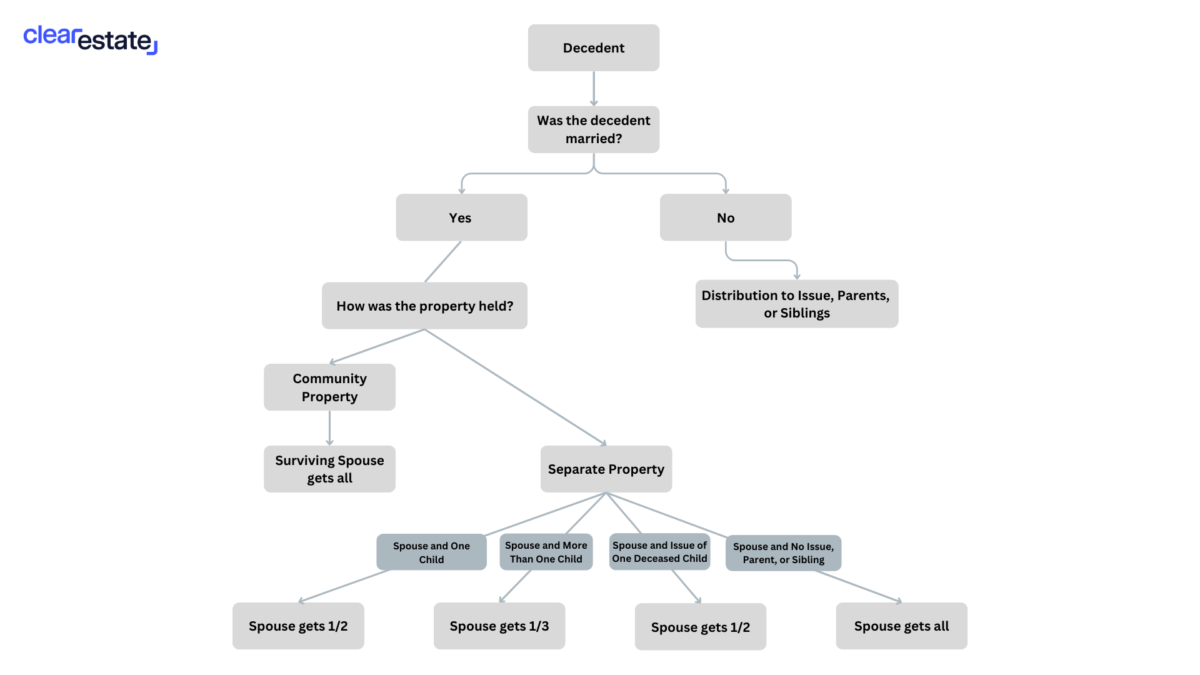

When a person dies without a will in California, their estate is distributed according to intestate succession laws. Under California Probate Code, assets typically pass to the closest relatives, starting with the surviving spouse and children. If there is no spouse or children, the estate goes to parents, siblings, and more distant relatives in a specific order. Wondering who inherits when there is no will? Check out our table detailing the Order of Estate Distribution by Intestate Succession Laws in California to see how assets are passed down under state law. To avoid probate complications, estate planning is essential.

Does a spouse automatically inherit property under intestate succession?

According to California's intestate laws - spouses do not automatically inherit all property. This is only the case when the decedent passed away without any surviving relatives, or if all property is owned and held jointly.

Does a surviving spouse need probate in California?

In California, probate may not always be required for the surviving spouse. If the deceased spouse estate is composed solely of community property or the assets were held in joint tenancy with another individual, including the surviving spouse, the estate can sidestep the probate court.

Who inherits if there is no beneficiary or next of kin?

Under California Probate Law 6800, any person who passes away intestate and with no living relatives, will have their property escheated by the State of California. This means that the decedent’s property becomes owned by the State. However, this can only happen after a “dormancy period” where the property remains unclaimed for a specific amount of time. For example, savings accounts and life insurance proceeds remain unable to be escheated until they have been inactive for three years.

What is the order of next of kin in California?

In the context of someone dying intestate, order of next of kin in California is a legal hierarchy indicating which family members are given priority to inherit the decedent’s estate. Under California’s Probate Code, the order is as follows:

Spouse or Registered Domestic Partner,

Children (biological or adopted),

Parents of the deceased,

Siblings of the deceased,

Nieces & nephews of the deceased,

Grandparents of the deceased,

Aunts, uncles and cousins of the deceased,

Great-grandparents of the deceased,

Stepchildren, where applicable

If there are no next of kin of the decedent alive, then the decedent’s assets become property of the State of California—a process known as escheat.

Can I still be an heir to a California estate if I am not an American citizen?

Yes. California’s Probate Law 6411 states that a person’s nationality or citizenship does not disqualify them from becoming an heir to an estate.

Are half-blood relatives able to inherit an estate the same as whole-blood relatives?

Yes, they are. California Probate Law 6406 ensures that half-blood relatives inherit the same share as they would if they were of the whole blood.