Time saving technology

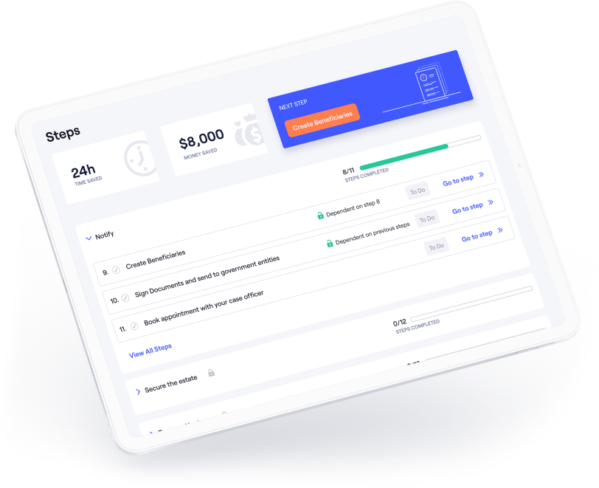

One-click forms, centralized documents, and seamless communication save valuable time and reduce complexity.

One-click form filling, centralized access to all important documents and easy online communication saves you valuable time so you can focus on what matters most.

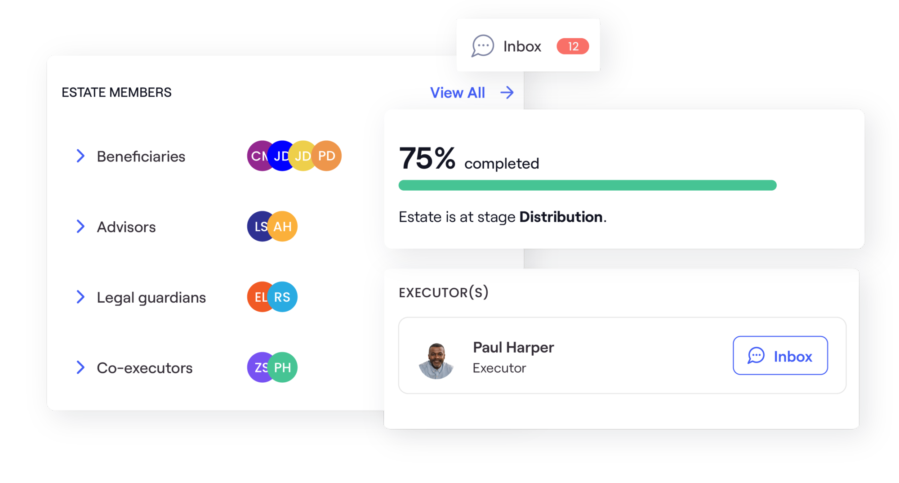

Our easy-to-use online platform guides you through every step of the process so you always know exactly what to do and what comes next. An efficient process means no hidden costs.

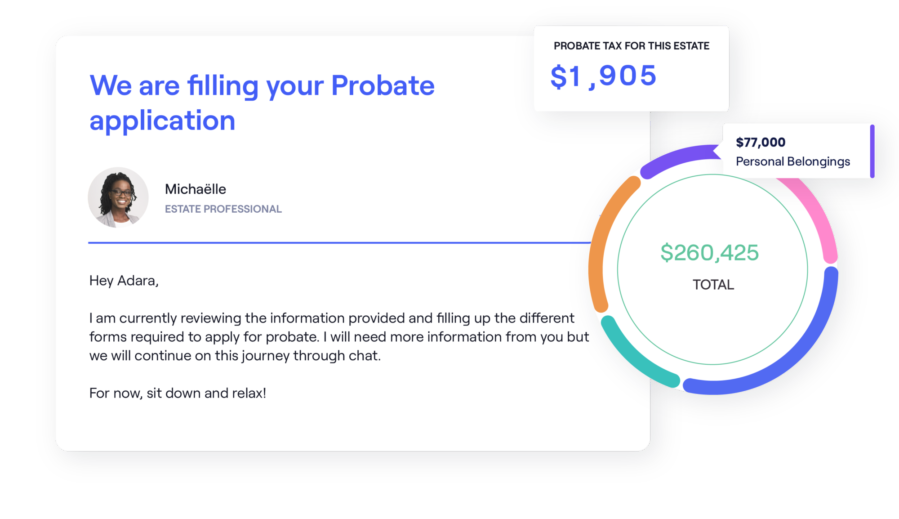

We do this all day, every day. Settling estates is our priority and we will be with you every step of the way: We’ll guide you from applying for probate and filing the right paperwork to taking care of taxes and closing the estate

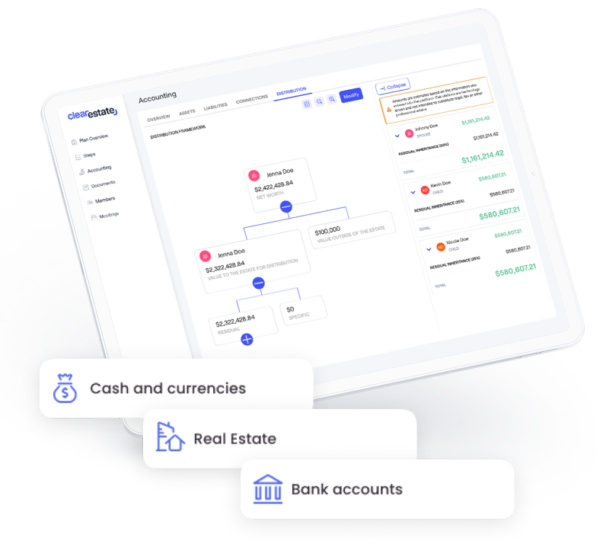

Estate settlement is simplified with our all-in-one online platform. Keep everything in one place, and easily track your progress with clear next steps, helping you move through the process quickly and confidently.

ClearEstate assists more families with their estate settlement needs per month than most lawyers do per year. Navigate estate settlement confidently with the help of our specialized team.

In times of grief, navigating estate settlement can be emotionally draining. We support families by easing the burden of estate administration.

Our goal is to clarify the complex settlement process, starting with our pricing. We fully disclose our simple pricing upfront; no hidden costs or hourly fees.

Here is what some have to say about their experience with us.

For executors seeking a streamlined process and expert support to apply for probate and settle an estate

Starting at:Included in this plan:

For executors seeking a streamlined process and expert support to apply for probate and settle an estate, including filing taxes

Starting at:Everything in Probate, plus…

For families seeking a professional executor to be responsible for the estate settlement, with ClearEstate handling the administrative burden, providing total peace of mind

Everything in Probate & Taxes, plus…

Compare all features

Settlement plan fees do not include the cost of notarization of signatures or documents, notice to creditors, estate administration tax, costs to transfer real title, services rendered to other professionals, such as appraisers, property managers, etc., or other estate expenses unless otherwise specified.

Some estates are more complicated to settle, such as where there are multiple executors, business interests, trusts, multi-jurisdictions, or where legislation requires an attorney or there is legal or tax advice or additional documents needed. In such cases, add-ons may apply and/or it may be necessary to engage external professionals at an additional cost to the estate.

*Professional Representative plan is provided in partnership with ClearEstate's trust partner and is subject to partner and court approval. Estates must be solvent and free from claims in order to qualify.

For more information, see our privacy policy and terms of use.

Legally, no, you do not need a lawyer to do the probate application, though it's actually really hard to fill it out without an experienced professional. That's one of the things that ClearEstate helps executors with.

Our experienced estate professionals will support you through the estate settlement process and prepare your probate application. If the circumstances require, we may have an estate attorney review the application, before submitting it.

Probate is the legal process of proving that a will is the Last Will and Testament of a deceased person. This process also confirms the appointment of an Executor - the person legally responsible for settling the estate.

Yes - we assist you with filing the probate forms in your name, and if additional petitions are required we can also support you through our professionals

We are not a law firm but we do work with a network of licensed legal professionals across Canada that help us draft wills and POAs. They will be outsourced by CE to draft the required documentation. Should you need independent legal advice for a specific matter, we can put you in touch with one of these legal professionals. Please note that our liability for any third party advice is limited as per our Terms of Use.

We offer a thirty-minute free consultation with one of our estate specialists. They will review your situation and make suggestions for the best path forward. It is a free consultation so you can choose to proceed with our services afterwards if you believe they are a good value or you can take the advice/information and go forward on your own

Through our platform and our team of professionals, we are able to lessen the administration hours and therefore save the estate from large settlement costs (incl legal fees). We also help you navigate the estate settlement process from beginning to end.

Using the information you provide, ClearEstate can automatically fill the petition for probate and ancillary documents. We can also prepare the required notification to the government agencies.

At ClearEstate we understand that a vast amount of people are going through this experience for the first time. Thus, it is not necessary for you to have prior experience because we created our services based on the fact that most people are inexperienced in Estate Settlements.

We serve in English and French

We have a team of estate administrators, lawyers and accountants to handle all of your needs, as well as developers who have built a series of tools to support estate settlement.