Thought Leadership

Aug 11, 2022

Patagonia’s Founder, Yvon Chouinard recently made the monumental decision to give away billions of dollars to fight climate change. He and his company have made massive changes, but by using the plethora of benefits that come with trust planning, these changes apparently aren't going to affect the core values of Patagonia; now, or in future.

Patagonia is a privately held outdoor gear company based out of Ventura, CA. Founded by Yvon Chouinard 50 years ago, in 1973, Patagonia is well known for its passionate defense of the environment, most notably through his company’s self imposed, “Earth-Tax,” which takes 1% from the corporation’s profits to provide financial assistance to environmental non-profits and other endeavors.

While the company originally started up selling hand-forged mountain climbing gear in the 1950s, it has greatly expanded into the outdoor apparel industry after Chouinard came up with the idea of using Rugby shirts to help with climbing sling injuries. Patagonia has continued to innovate and change the landscape of the apparel industry with their somewhat unconventional strategies.

Throughout the founding of the apparel company, caring for the environment has always been a top priority. In a public letter, Chouinard notes that in 2018 the company changed their core purpose to, “We’re in business to save our home planet.” signifying an even deeper commitment to the planet. Interestingly enough, these environmentally focused values will continue to persist through these new shareholder changes that radically affect Patagonia’s structure.

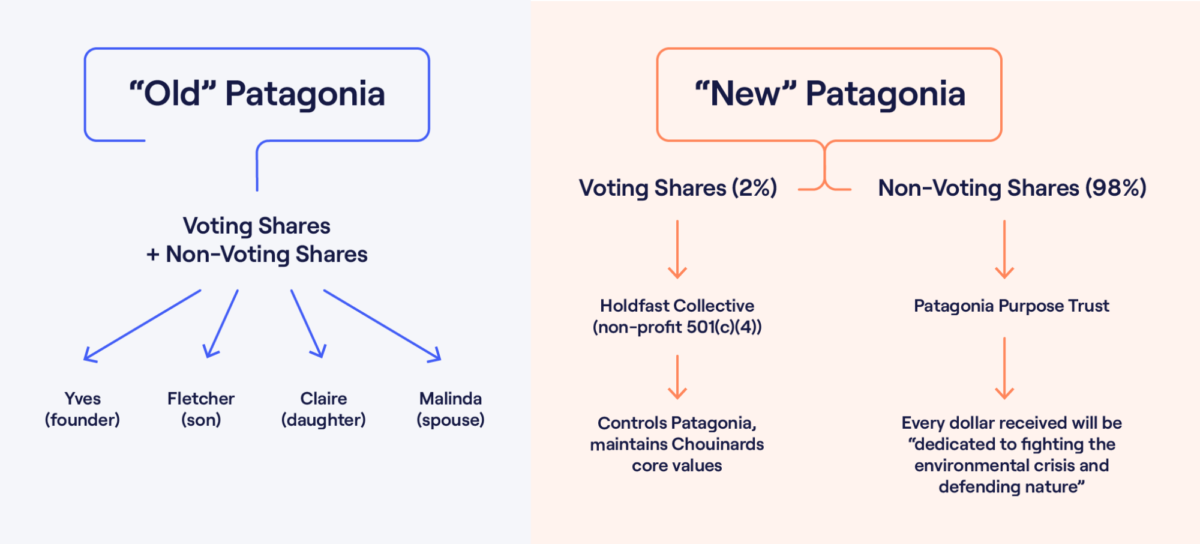

Up until last month, Chouinard and his family were the sole voting shareholders in Patagonia.

However, Chouinard and family have irrevocably transferred their voting stock (2% of all Patagonia stock) to the “Patagonia Purpose Trust”. This transfers all of the company’s decision making authority to the trust (a fiduciary relationship where trustee/s set aside assets for the benefit of the beneficiary/ies), as that is where all of the voting power lies. This trust will be overseen by the Chouinards and their closest advisors, further solidifying their continuous involvement in Patagonia regardless of their shareholdings. This move will ensure the original mission to run a socially responsible enterprise and give back profits to the planet will remain well into the future–including beyond the Chouinards’ lifetimes.

The other 98% of the company’s stock (non-voting) has been donated to a non-profit called the “Holdfast Collective” where every dollar received will be, “dedicated to fighting the environmental crisis and defending nature.” Part of the reasoning for such a bold claim is the key point that Holdfast Collective is a 501(c)(4), a charity that has the ability to donate unlimited amounts of funds to political groups. More on that below.

Although the Holdfast Collective is a non-profit, it is registered as a 501(c)(4) and not a public benefit charity 501(c)(3). This means its activities will not be restricted by various regulations that affect 501(c)(3) charities. Because of this strategic move, Holdfast Collective will be permitted to lobby and make political donations unlike public benefit charities. This decision also does not limit Holdfast Collective’s ability to own the majority interest in Patagonia. It does mean that donations to Holdfast Collective are not tax deductible, however. This indicates the Chouinards were not able to use the donation of the 98% of Patagonia’s stock to offset their other income.

While the above changes have many different benefits as noted, there are still some tax consequences triggered by the change. The Chouinards will have to pay US gift tax on the shares they have transferred to the trust, however, they will only pay gift tax on their initial investment in Patagonia and not on its current worth, which is estimated at a whopping $3 Billion. This means they will pay approximately $17.5M in taxes, but that is a substantial tax savings from the $700M that they would owe if they were to sell their shares via a standard sale transaction.

As an additional benefit, when the Chouinards pass away, given that they will not have their fortune in their estate, they will effectively (and legally) avoid the 40% US estate tax normally levied against large estates.

The funds Patagonia generates each year after reinvesting in the business will be distributed to the non-profit Holdfast Collective in the form of dividends. Providing the business continues to be healthy, this is estimated to be about $100M annually; a substantial amount, to be sure.

While Patagonia’s change is quite clearly motivated by sophisticated tax-planning strategies–as many corporate restructuring plans are–Chouinard's plan is slightly different. In cases where the restructure was solely motivated by tax savings, Chouinard could have used a 501(c)(3) corporation, in which case the donation of shares would have also been tax deductible. But, this moving of shares and voting power using trust planning provides greater value driven benefits that are not always seen in the traditional business world.

For Yvon Chouinard, the key benefit of this transaction seems to be the retaining of their values, the most important being protection of the environment. This structure enables Chouinard to control the future direction of Patagonia through the terms of the Purpose Trust, as it holds the voting power. It enables certainty that the core values upon which Patagonia was built will be maintained well into the future, even in the event of Chouinard’s passing. It also ensures significant ongoing financial donations towards environmental causes. This certainty would simply not be possible were the Chouinards to sell the company or take it public.

Moreover, Chouinard’s choice to place Holdfast as the non-voting shareholder was no accident. Here’s how Chouinard himself describes them, “a nonprofit dedicated to fighting the environmental crisis and defending nature.” Using trust planning allowed the Chouinards to not only receive great fiscal benefits but also stay true to the values they have been committed to upholding since Patagonia’s inception.

It is also prudent to note that Patagonia’s decision to put Holdfast–a 501(c)(4) charity–as the majority shareholder, comes with the benefit of having its dividends in the hands of an organization that can legally make unlimited political donations. This further allows the values of the Chouinards to not only stay intact but also be realized in a more concrete fashion through the greater reach of this non-profit.

Patagonia will continue to operate as a for-profit corporation (with estimated retail sales of about $1 Billion per annum) in the outdoor apparel sphere. It will also continue to maintain its status as a B Corp (certification for businesses meeting high standards of verified performance, accountability, transparency, employee benefits, charitable giving, etc.) and continue to donate 1% of sales each year to grassroots environmental organizations. As noted earlier, this self-imposed Earth Tax has been in place since the 1980s and has generated $140 Million in donated funds.

In summary, Patagonia leveraged a key trust initiative to realize tax breaks and, more importantly, use these advantages to further its vision. In the words of Yvon Chouinard, “Instead of ‘going public,’ you could say we’re ‘going purpose.’” The Chouinards could easily have considered higher tax-saving strategic options, but it was their core values which ultimately guided their decision.

While it may seem daunting and far-fetched to compare your estates and/or assets to a transaction such as this, taking advantage of the various trust planning strategies available can be within anyone’s grasp. One of the most cost-effective ways to realize tax benefits and maximize your legacy is through careful, precise estate planning. In addition, trusts can help you accomplish various goals, including probate savings, marital breakdown and creditor protection, providing for the financial needs of loved ones, charitable giving, etc. At Clear Estate, we offer both simple and complex solutions for planning your estates, from straightforward plans to trust creation and professional executor services and everything in between. Why? So you can not only use value driven tax-saving strategies but also help these values be realized during your lifetime and beyond. Like the Chouinards did.

Need help with probate?

Need help with probate?

Get free, personalized guidance from our estate specialists who have guided over 10,000 families through probate. Book a free, no hassle and confidential consultation today.

Book a free consultation today