Estate Settlement

Dec 04, 2024

How Do Executors Mail Inheritance Checks?

Find out how inheritance checks are mailed, including security measures and what to do if there are delays in receiving them.

Filing the terminal tax return in Canada doesn't have to be hard. Use our step-by-step guide to filing the terminal tax return for the deceased in Canada below:

Filing the terminal tax return for a deceased individual is a pivotal part of the estate settlement and probate process in Canada. It's a task that intertwines the complexities of tax law with the emotional realities of loss, making it a uniquely challenging responsibility.

As difficult as this may be, the Canada Revenue Agency expects the deceased person's legal representative to file the final tax return by the end of the current or next financial year. This unique filing process is known as a terminal tax return.

When an individual dies, their recent tax responsibilities remain valid until the time of death. Since they cannot file their tax return, the person designated as the personal representative takes the role of filing it. This final tax return filed on behalf of a deceased person is called a terminal tax return.

Generally, the terminal tax return in Canada is due the following year after the person's death. However, the personal representative will only file till the month the person dies. For example, if the person dies in August, the terminal tax return will show their tax information until August instead of December (the standard timeline for everyone).

The Canada Revenue Agency requires the personal representative to gather and submit all the documents containing the deceased person's income and expense information. If not, the entire process will be considered incomplete, and the executor or personal representative may be penalized.

The Canadian government puts the responsibility of filing the terminal tax return with the executor. Outlined in the will, but appointed legally through the court - the executor is ultimately responsible for filing the terminal tax return.

If the decedent passed away without a will, or a will without having named an executor - the court will assign someone, or someone along the prioritized line of heirs or other interested persons can apply for executor.

The administrator or executor must act in the best interest of the beneficiaries and the deceased person's estate. They achieve this by adhering to the final tax return regulations. If they do not fulfill their responsibilities, the court may hold the executor liable for any losses the beneficiaries or estate suffer.

The Canada Revenue Agency requires you to fill out the terminal tax return either six months after the time of death or on April 30 of the year following the date of death. For example, if the person died on February 2, 2023, you must file the terminal tax return by July 30, 2023, or April 30, 2024.

This generous provision gives you reasonable time to gather all the necessary tax information and documents. If you cannot make the deadline due to unavoidable circumstances, make an effort to estimate the income and taxes to be paid and clear a portion of the amount due to show your desire to do things legally.

You can also request an extension from the Canada Revenue Agency (CRA) to avoid interest and penalties charged for late filing. When you get stuck and the deadline is approaching, consult an attorney or tax professional to help you navigate the CRA requirements within the remaining time.

We recognize that the process of filing taxes can be challenging, but navigating tax returns for a deceased loved one can be an even more daunting task.

To help you, we've created a simplified step-by-step process of filing a terminal tax return.

One of the first steps an executor must take when dealing with the estate taxes - is to notify the CRA.

To do so, the executor has to apply to the Canada Revenue Agency (CRA) to become an Authorized Representative. This status grants them access to the deceased individual's CRA account.

With this access, the executor can view and handle all outstanding tax returns, which is a crucial part of settling the estate. This role also allows them to review notices of assessment, ensuring any due taxes or refunds are appropriately addressed.

Moreover, the Authorized Representative will be able to access important filed tax slips such as T4s, T4A, T3, and others, which are crucial for accurate and efficient tax filing. These documents are uploaded within the deceased's CRA account, providing all necessary information at their fingertips. This streamlines the process and alleviates some of the administrative burdens during this challenging time.

Gathering the necessary documents needed by CRA assists them in getting an overall picture of your deceased loved one's financial situation. Canada requires the legal representative to submit documents containing all income and expense sources.

They include:

The following table summarizes other documents you need to have:

| Terminal Tax Return Document Needed | What it Covers (Purpose) |

| T3 | Trust and estate income |

T4 | Employment income (salary, wages, and commissions) |

| T4A | Self-employment income and pension income |

| T5 | Investment income (dividends, mutual funds, and interests) |

| Statement Of Business | Business income and expenses |

| Property Sale Documents | Purchase agreements and statements of adjustments |

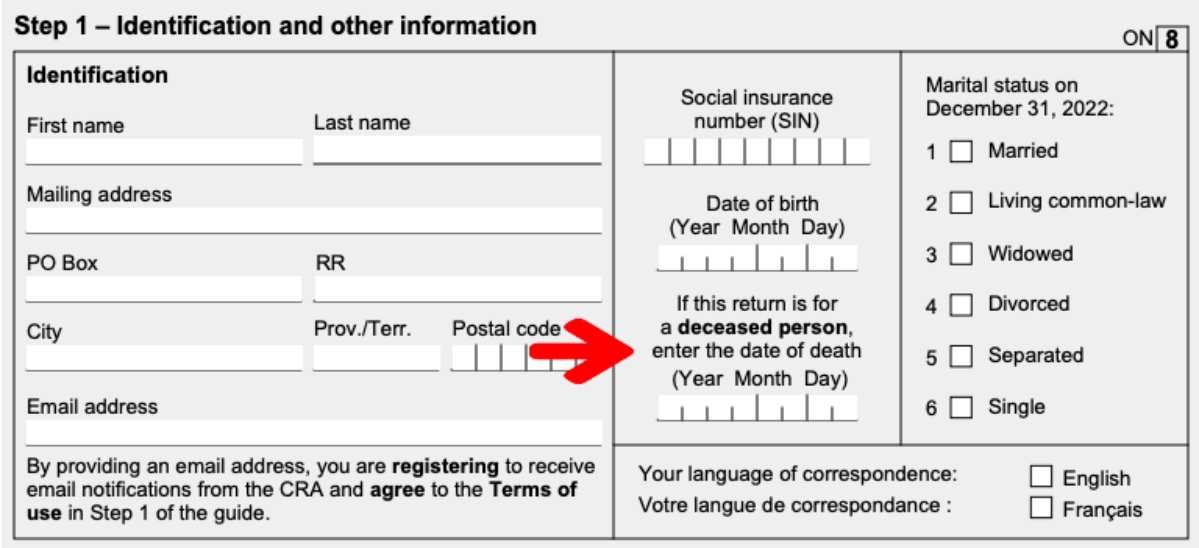

When filling out the tax return, it is mandatory to use the regular T1 income tax return form provided by CRA. The T1 form is also called the Income Tax and Benefit Return. All Canadians use it to file their personal income tax.

In this unique situation, you must indicate on the form that the return is for a deceased person.

The information you must provide in the T1 form includes the following:

If you make a mistake after submitting the T1 form, notify CRA immediately, and they will give you the process of adjusting or amending the affected section.

In most instances, legal representatives fail to capture all the deductions and credits the deceased person accrued. This missed opportunity causes the tax liability to be more than it should have been, meaning fewer gains for the beneficiaries. The deductions and credits to look out for include the following:

Ensure you have the supporting documents, such as statements and receipts, to prove the deceased person qualified for the specific deductions and credits.

Once you have completed steps one to three, it is time to finalize the process and confirm you have acquired all the documents and filled the tax return correctly. Here is a summary of the submission process:

CRA may request additional documentation after you submit the terminal tax return and documents. If they reach out, respond immediately to enable you to finalize the process quickly. Once they review the terminal tax returns, they will refund any money gained or request you to make payment arrangements to settle the pending tax liability.

Filing a terminal tax return comes with various challenges you must address to allow you to perform this vital task well. Let's look at some of these challenges and how to solve them in the table below.

| Potential Challenge | Solution |

| Locating crucial documents |

|

| Decoding financial jargon |

|

| Managing the process while dealing with grief |

|

| Complex financial situation |

|

Filing the terminal tax return of your deceased loved one is an essential task that requires attention to detail and adherence to Canada's tax regulations.

In this comprehensive guide, we have discussed the main factors to consider, including filing within six months to one year of the date of death. We also looked at how to file and what you need to succeed despite the challenges you may face.

However, if you are overwhelmed by the filing process, or the estate administration in general - you can book a free consultation with our estate tax professionals, where we can guide you through the process of settling your loved ones estate. Let us help you in this challenging time.

Simplify Probate Today

Simplify Probate Today

Get expert guidance from our probate specialists who've helped 10,000+ families.

Book a free consultation today