Estate Settlement

Dec 04, 2024

How Do Executors Mail Inheritance Checks?

Find out how inheritance checks are mailed, including security measures and what to do if there are delays in receiving them.

Alberta has one of the lowest probate fees in the country, starting from $35 and maxing out at $525. In this post we'll breakdown the payment thresholds for probate fees.

Probate fees are determined by the Surrogate Court of Alberta based on the estate's net value - these fees are detailed by Judicature Act Surrogate Rules Part 5 Schedule 2 and are as follows:

| Net Value of The Estate | Probate Fee |

|---|---|

| $10,000 or under | $35 |

| $10,000 - $25,000 | $135 |

| $25,000 - $125,000 | $275 |

| $125,000 - $250,000 | $400 |

| $250,000 + | $525 |

The above information is current as of July 1, 2024.

Use this calculator to estimate the probate fee for an estate in Alberta:

While the probate fee is paid for by the estate, the executor/administrator is ultimately responsible for paying the fee (which is re-imbursable by the estate) and is usually paid for when applying for the grant of probate (if there is a will) or grant of administration (no will) - the process is still the same when the deceased died without a last will.

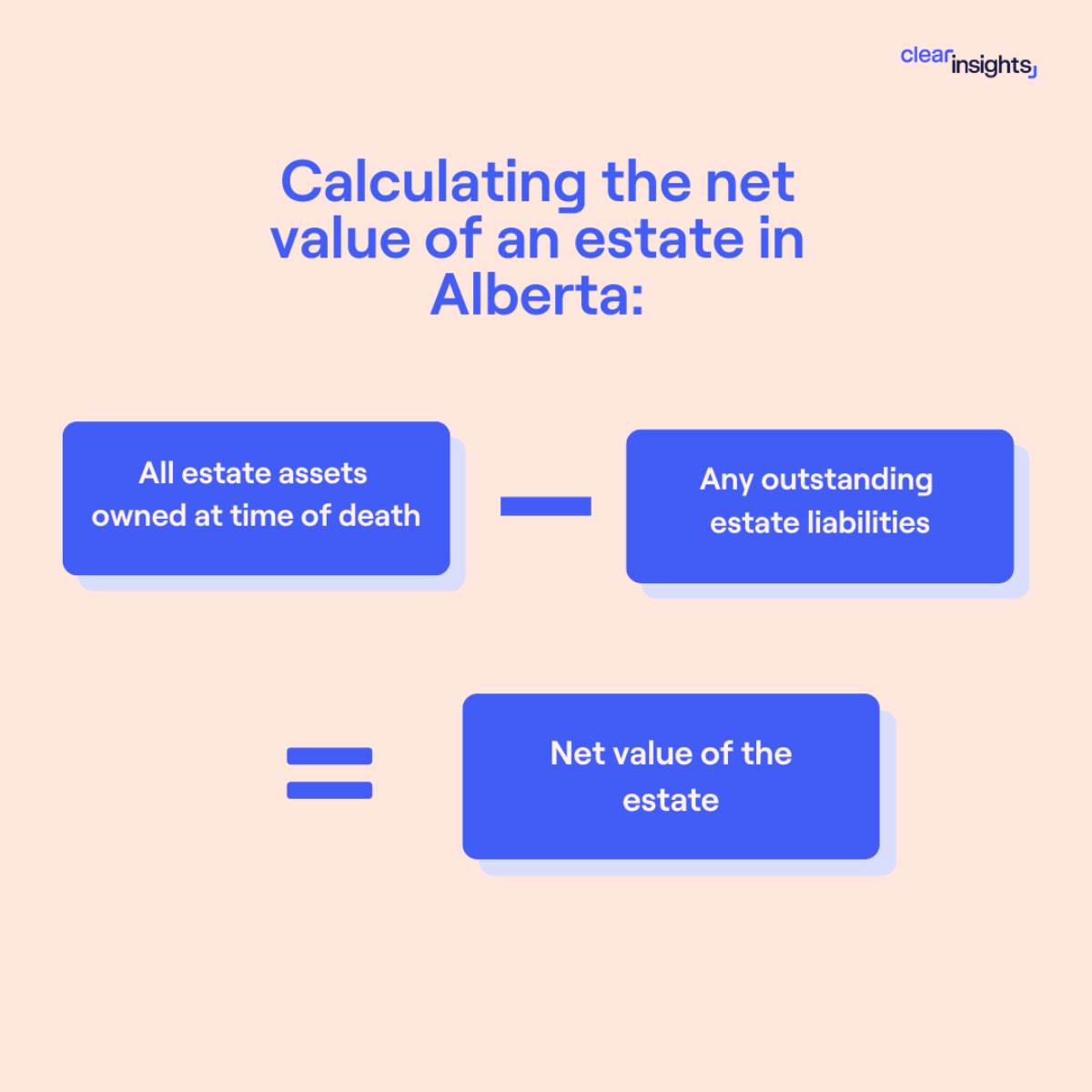

Unlike other provinces in Canada that charge their probate fee on the gross value of the estate assets, Alberta charges their probate fee on the NET value of the estate.

This calculation can be viewed as:

All estate assets owned at time of death - any outstanding estate liabilities = Net value of estate

To calculate the value of the estate, one would have to understand what assets would count towards the estate value.

Business interests: This can include sole proprietorships, partnerships, and corporations. Probate may be required in order to transfer ownership of these businesses to the beneficiaries.

Real property: This includes homes, land, or other types of real estate that are owned solely by the deceased.

Personal property: This can include things like furniture, automobiles, jewelry, and other personal belongings. In some cases, probate may be required in order to sell or distribute these items.

Financial assets: This can include things like bank accounts with no listed beneficiaries, stocks and bonds, and life insurance policies - in most cases, financial institutions require a listed beneficiary upon registering an investment account like an RRSP, or bank account which allow the beneficiary to inherit without going through the probate process.

In most cases, any assets owned solely by the deceased will most likely require probate and should be included when determining the estate’s net value.

Just like the executor fee, probate lawyer fees do not have a set statue - but they are given a guideline by the law society of Alberta and are as follows:

Although there is no legal statue for executor’s compensation, there is a guideline laid out by the surrogate court of Alberta and they can be broken down into groups as follows:

Compensation for total estate value

The net value of the deceased assets as of the date of death.

Compensation for total asset revenue

Cash flow or assets that the estate accrues with the executor or trustee administering the estate.

Estate management

Assets that are being managed by the administrator, trustee, or executor during the distribution period.

As stated by the Alberta surrogate court, these are the most common administrative fees executors will be faced with:

| Administration Activity | Fee |

|---|---|

| Documents that require the opening of a court file respecting an estate | $250 |

| Issuing a grant of double probate, supplemental grant, or grant of administration of unadministered property | $250 |

| Application for trusteeship | $250 |

| Application (in the course of an action or proceeding respecting an estate or trusteeship) | $50 |

while not outlined - court filing fees, and court-certified copies are other administrative costs you may incur.

As you can see - Probate can end up costing thousands - if not 10's of thousands of dollars to settle an estate.

Estate settlement requires; Probate fees, legal fees, accounting fees, executor fees, admin fees, on top of a whole lot of other variables such as extended probate hearings, contested wills that can prolong the probate process - costing the estate thousands more dollars.

See you can either go to a probate lawyer and they just do probate for you and end up charing 5% of the estate's value.

Or you can use ClearEstate, where we cover you for the entire estate settlement process at a simple flat fee.

Book a free consultation with us today.

Simplify Probate Today

Simplify Probate Today

Get expert guidance from our probate specialists who've helped 10,000+ families.

Book a free consultation today